NEWS

Student Loan Repayment To Resume in October Even If The Government Shuts Down

Published

8 months agoon

By

Matthew Hall

More From Politically+

-

Protesters unravel Overturn Roe? Hell no! banner during Dodger Stadium…

-

Sen. Raphael Warnock Election Night Party In Atlanta, GA: Celebration…

-

Columbus Board of Education issues statement after Emergency Meeting due…

-

US Senator Bob Menendez and wife charged with bribery

-

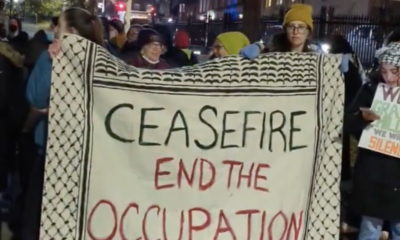

🇵🇸 Protestors in North Carolina take the streets to #ShutItDown4Palestine…

-

Georgia Senate Runoff Early Voting Line, It was a privilege…

-

President Biden and The First Lady Host Halloween at the…

-

Mark Hamill (Luke Skywalker) at White House Press Briefing Ahead…

-

MORE: Solidarity Pride March Following Shooting at Gay Club in…

-

Military Seeks Public’s Help Locating Missing F-35 Jet After ‘Mishap’…

-

Sen. Bob Menendez Tells Democrats Will Not Resign As He…

-

Jewish Voice For Peace Activists Sing Pro-Ceasefire In Palestine Carols…